Historically, index deletions have beaten the Russell 2000 Value Index in spectacular fashion and could add an abnormal upside to a portfolio when the current growth-dominated bubble starts to deflate.

Deletions lag the market by more than half in the year leading up to their removal from an index, but they historically outperform the market for at least five years after the breakup.

A deletions strategy relies on two growth drivers to fuel performance: long horizon mean reversion and a liquidity effect.

No one enjoys getting dumped. This holds true in finance and investing as much as it does in romantic relationships. When companies are dumped from the major indexes, their managers and shareholders may feel jilted and their stock may flounder post-breakup. But according to our research, deletion-related downward spirals are hardly inevitable. As it turns out, getting dumped by an index can have an impressive upside, just as a romantic breakup can sow seeds for personal growth. Dumped companies and their shareholders fare surprisingly well on average, better even than the stocks that replaced them.

Create your free account or log in to keep reading.

Register or Log in

Here's how it works. All the established index providers have roughly the same modus operandi. They add stocks that have become valuable and popular enough to catch the investment community’s eye, whether through the subjective judgment of an investment committee like the S&P or MSCI indexes or through a formula based on market capitalization or float like Russell’s. On the other hand, unless the breakup results from a merger or acquisition, dumped stocks are almost always unloved, out of favor, and no longer valuable enough for the index provider to pay them any attention. They have, in dating parlance, let themselves go. The S&P 500, the Nasdaq-100, the Russell 1000 all drop the fading older companies to make way for the Teslas and Nvidias, the exciting and frothy new additions.

How Do Nixed Companies Fare?

We have explored index additions and deletions and associated issues in an array of research papers over the years, and our findings have inspired a new approach to cap-weighted indexing.1 In each paper, we keep a narrow focus on one aspect of this work: the reconstitution of a cap-weighted index. The reconstitution puzzle is a rich and nuanced topic, and our analysis has revealed several striking characteristics:

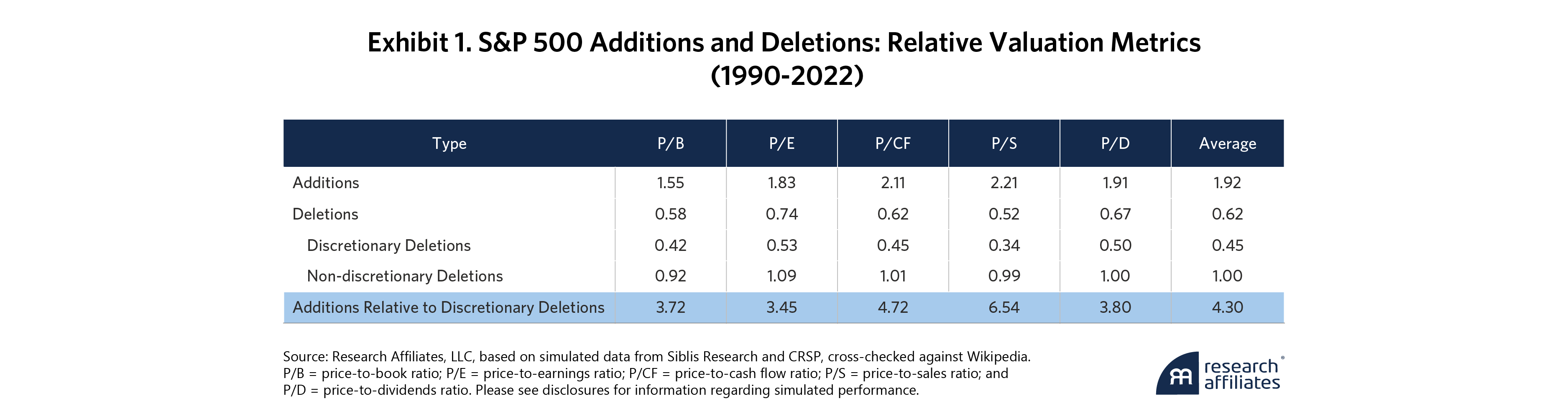

- Over the past 33 years, additions have generally outperformed the market in the year before the index reconstitution, while discretionary deletions have underperformed. How powerful is this performance difference? Additions have typically more than doubled compared to the stocks they replaced.

- When an index is reconstituted, added and deleted stocks tend to exhibit a wide valuation gap relative to their underlying fundamentals. Exhibit 1 shows that additions are priced at roughly twice the market multiple and discretionary deletions are priced at roughly half the market multiple. This enormous four-fold spread implies an equally enormous gap in the companies’ expected future prospects.

- Index reconstitutions generate stupendous momentum that should reward additions and punish deletions. But with a half-life of about three months, momentum tends to be a short-lived phenomenon. It also has a largely unrecognized reversal of its own: When held on a long-term basis rather than with monthly rebalancing, past winners reverse course relative to losers after 6 to 12 months and give back all their early gains and become net losses within 12 to 24 months.2 What’s worse, over the last quarter-century, “standard momentum” hasn’t even worked! It has a negative average alpha since 1999.

- The substantial outperformance of additions relative to deletions, between the date a change is announced and the date when the change takes effect, front-loads that entire momentum effect. Empirically, there’s nothing left beyond a day or two following index reconstitution.

- Additions modestly underperform their index over the subsequent year on average, with S&P 500 additions lagging the market by 1% to 2% from 1990 through 2022. Deletions, by contrast, outperform by more than 5% per year for the next five years.

This paper focuses on deletions, the stocks dumped by major index providers, and their potential for robust post-breakup outperformance.

A deletions strategy benefits from long horizon mean reversion and from a liquidity effect: Deletion decisions initiate rapid selloffs. Total assets indexed to the S&P 500 are over 20% of the index’s total market capitalization. So, 20% of the total market capitalization of new additions and deletions changes hands in the days immediately surrounding the index reconstitution. Most of this trading occurs in a single “market on close” block trade that coincides with the reconstitution of the index.3 In this way, index funds create the illusion of zero trading costs, in order to achieve near-zero tracking error. Deletions experience massive selling pressure since index fund investors must unload their shares; as a result, the market clearing prices of dumped stocks are often much lower than what they would have attracted before the deletion decision. This sets the stage for an impressive rebound.

One nuance is beyond the scope of this paper: flip-flops! Sometimes after a deeply depressed stock is deleted, its circumstances improve and it is re-added to the index at a newly inflated multiple. Sometimes this cycle repeats several times.

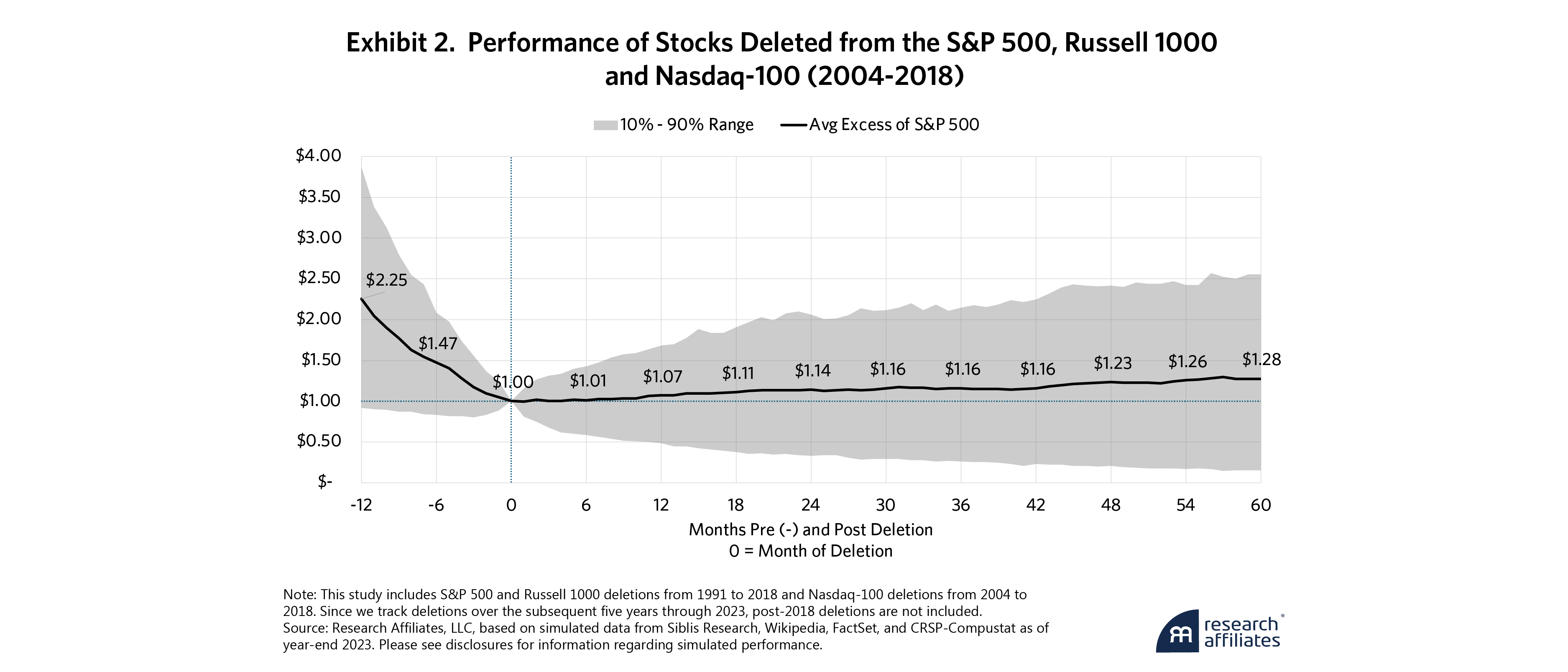

Portfolios of Deletions

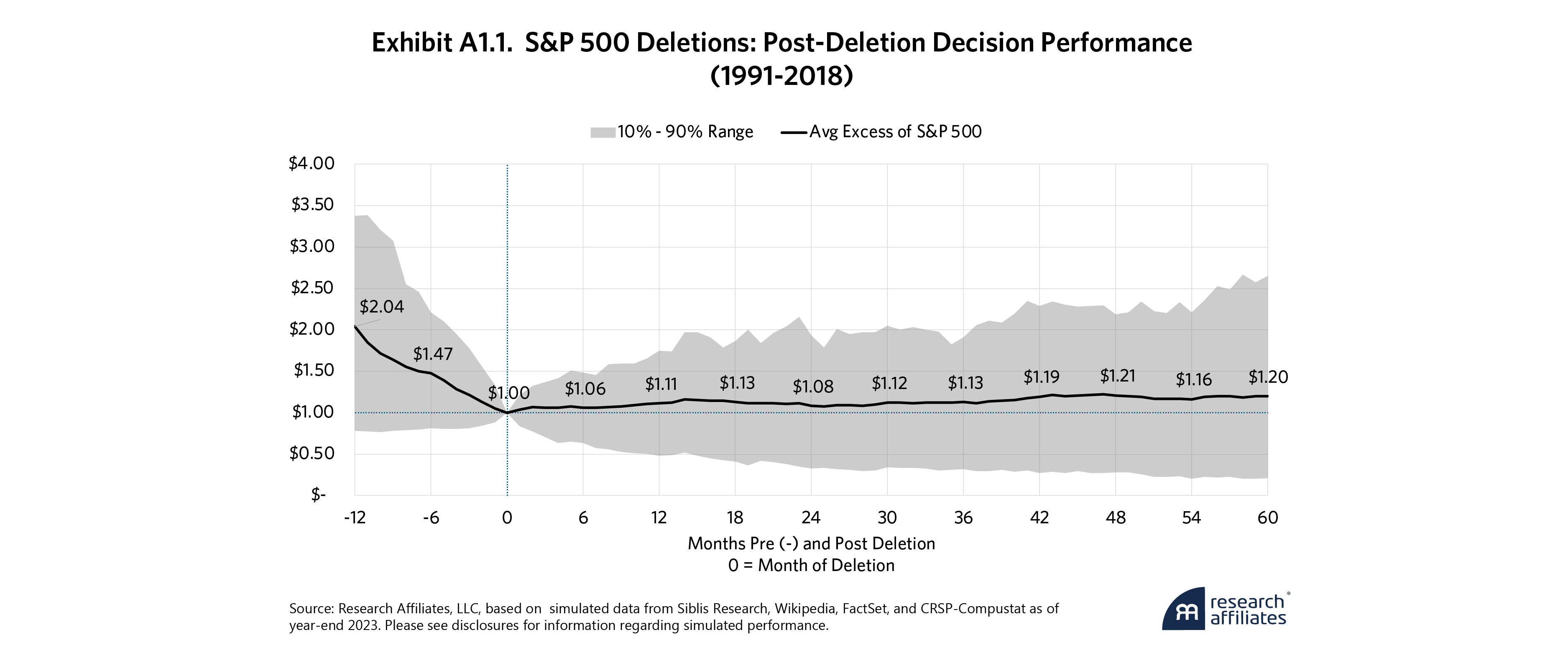

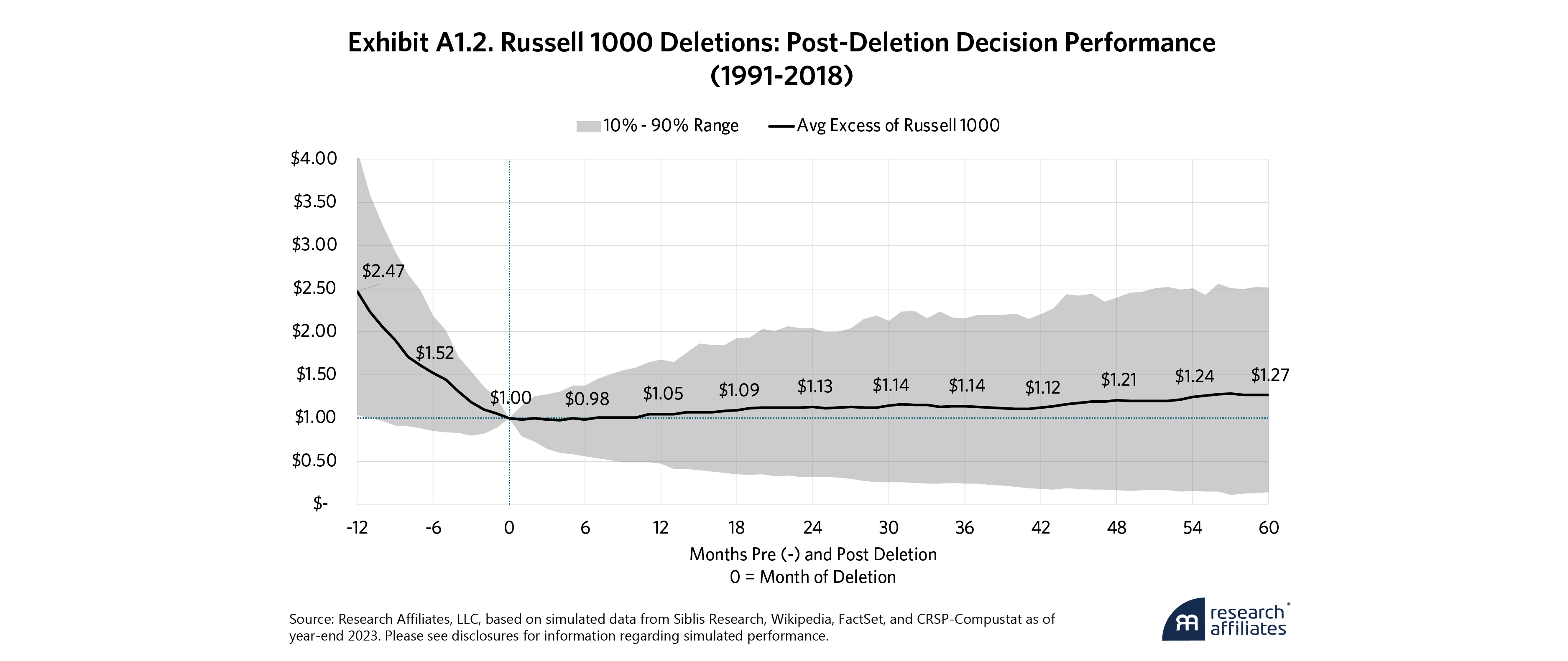

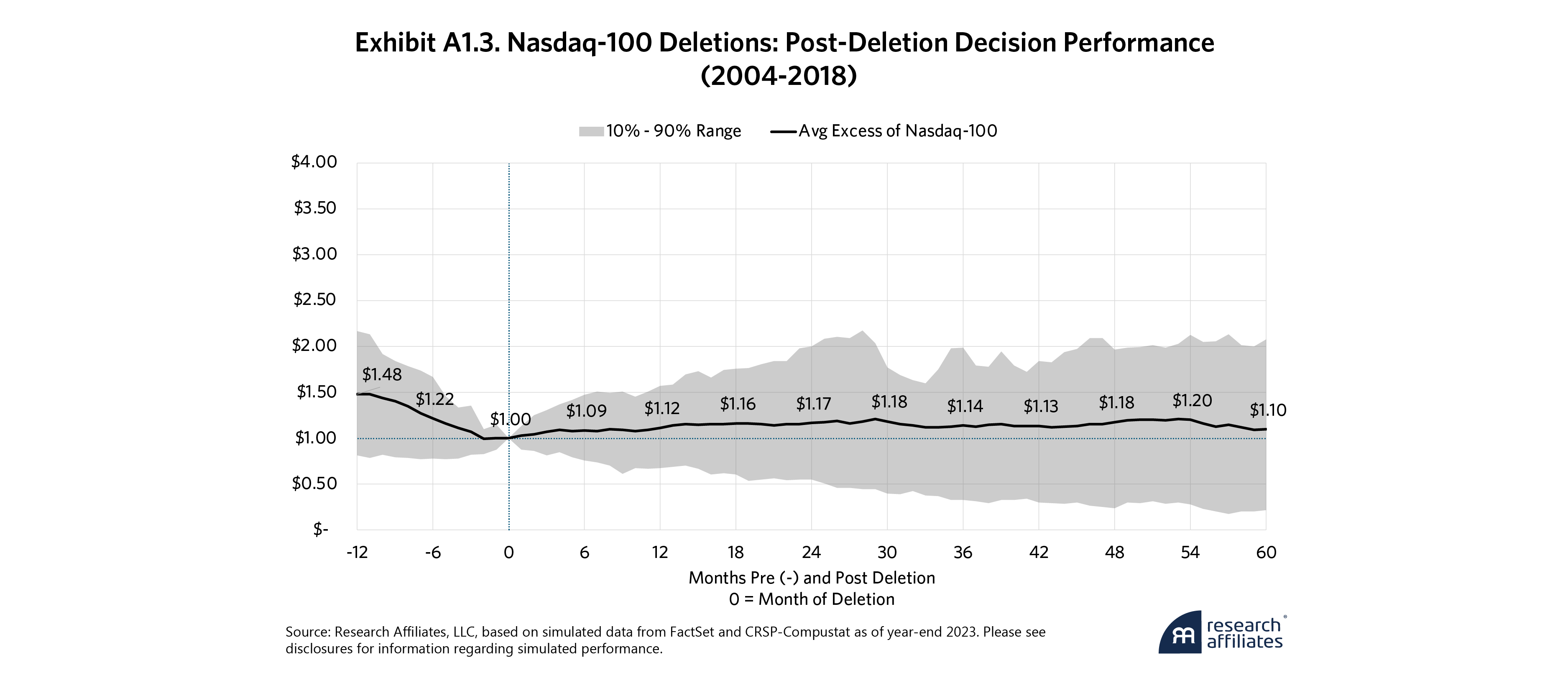

Exhibit 2 shows how nixed S&P 500, Russell 1000, and Nasdaq-100 stocks perform in the year prior to, and in the five years after, their deletion.4 The gray band illustrates the range of excess individual stock returns during those sample periods, from the 10th to 90th percentile. As the far left of the graph indicates, rare outliers (less than 10% of deletions) were at least four times as expensive one year before their deletion. They are sold after a 75% drop! At the other end of the spectrum, about 10% of deletions were cheaper than the S&P 500 one year before they were dumped. Five years later, the outlying deciles were down by more than 80% and up by 150% or more.

As a portfolio, deletions have fallen by more than half relative to the market in the year before their removal. That’s an even stronger result than we found in our 2023 examination of index rebalancing.5 Deletions historically beat the market for at least five years post-breakup. Their annual outperformance is remarkably persistent and statistically significant, averaging over 5% per annum, compounded over the first five years.

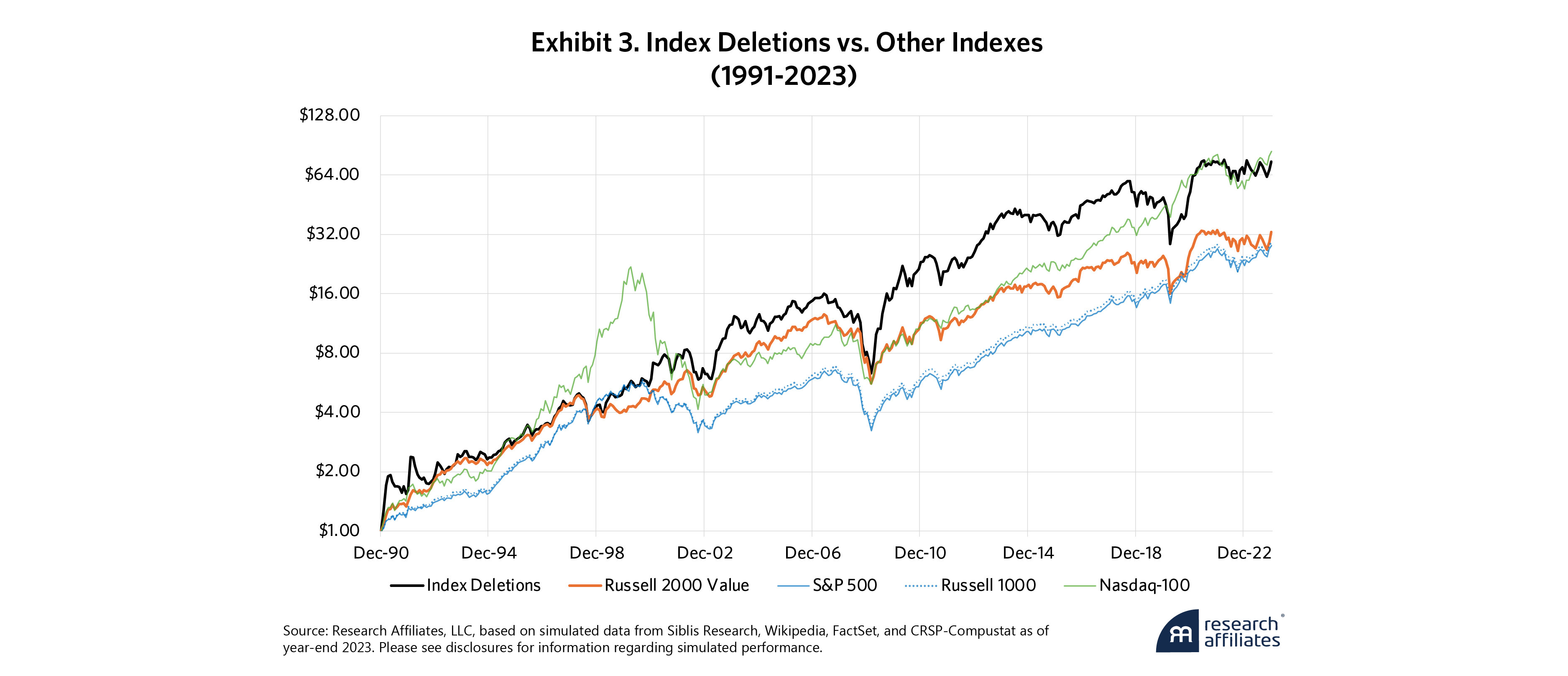

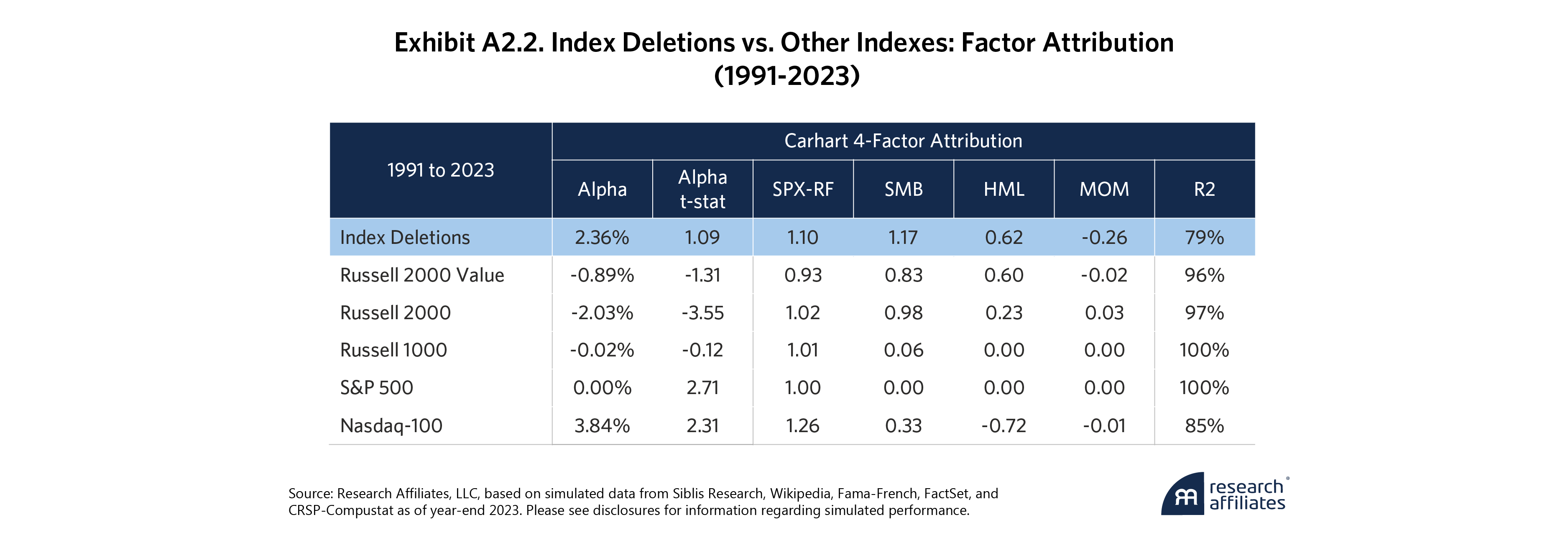

Exhibit 3 shows the growth of one dollar invested in a deletions strategy vs. the Russell 2000 Value and the indexes that dropped them. Why the Russell 2000 Value? Because any S&P 500 deletion is, by definition, not a member of the S&P 500. By the time they are dumped by the S&P 500, many S&P 500 deletions have also fallen out of the Russell 1000. Russell 1000 deletions are likewise, by definition, not members of the Russell 1000. That means most deletions are trading on the Russell 2000 at steep discounts. They are small-cap value stocks. That is why a small cap value index is the appropriate benchmark for a portfolio of dumped S&P 500 or Russell 1000 stocks.6

Growth’s dominance will likely come to an end, and when it does, almost anything should beat the S&P 500 and Nasdaq-100. If the Russell 2000 Value is winning big and deletions can beat the Russell 2000 Value, a deletions portfolio could deliver truly remarkable outperformance.

”Not everybody recognizes this. We recently shared commentary, entitled “Imitation is the Sincerest Form of Flattery,” with our Research Affiliates Insights subscribers in response to analysis of the performance of index additions and deletions by Dimensional Fund Advisors7 and S&P.8 Their results support ours. But they use the S&P 500 as their benchmark. That is a mistake. How could deletions not lag the S&P 500 during the small-cap value rout of the last decade and the stunning ascent of the “Magnificent Seven” in 2023 and the first half of 2024? Since deletions are generally small- and mid-cap, and are almost always deep value stocks, the Russell 2000 Value is much more relevant, and deletions fared well compared to it during much of this difficult span. We can only imagine how they will perform should small-cap and value stocks stage a significant recovery, as we think is likely in the coming decade.

Exhibit 3 also shows that the S&P 500’s performance is nearly identical to the Russell 1000’s, with the Nasdaq-100 following a more tumultuous trajectory. Because this is on a log scale, if one line is rising faster than another, that index is winning. Absent fees, taxes, spending, and other charges, an investor in a broad deletions portfolio for the five post-deletion years would be 74-times wealthier at year-end 2023 than in January 1991. Only a Nasdaq-100 investor would fare as well, albeit with higher volatility and the harrowing drawdown of the dot-com crash. After 30-plus years, S&P 500, Russell 1000, and Russell 2000 Value investors would be 55% to 65% poorer than our brave deletions investor.

Deletions haven’t beaten the Nasdaq-100, S&P 500, or Russell 1000 over the last decade. This raises the question: Why bother? It all comes down to value and value’s recent travails. The current growth-dominated bull market has left value and small-cap stocks in the dust. In this climate, nothing beats the S&P 500 or Nasdaq-100. But growth’s dominance will likely come to an end, and when it does, almost anything should beat the S&P 500 and Nasdaq-100. If the Russell 2000 Value is winning big and deletions can beat the Russell 2000 Value, a deletions portfolio could deliver truly remarkable outperformance.

Absent fees, taxes, spending, and other charges, an investor in a broad deletions portfolio for the five post-deletion years would be 74-times wealthier at year-end 2023 than in January 1991.

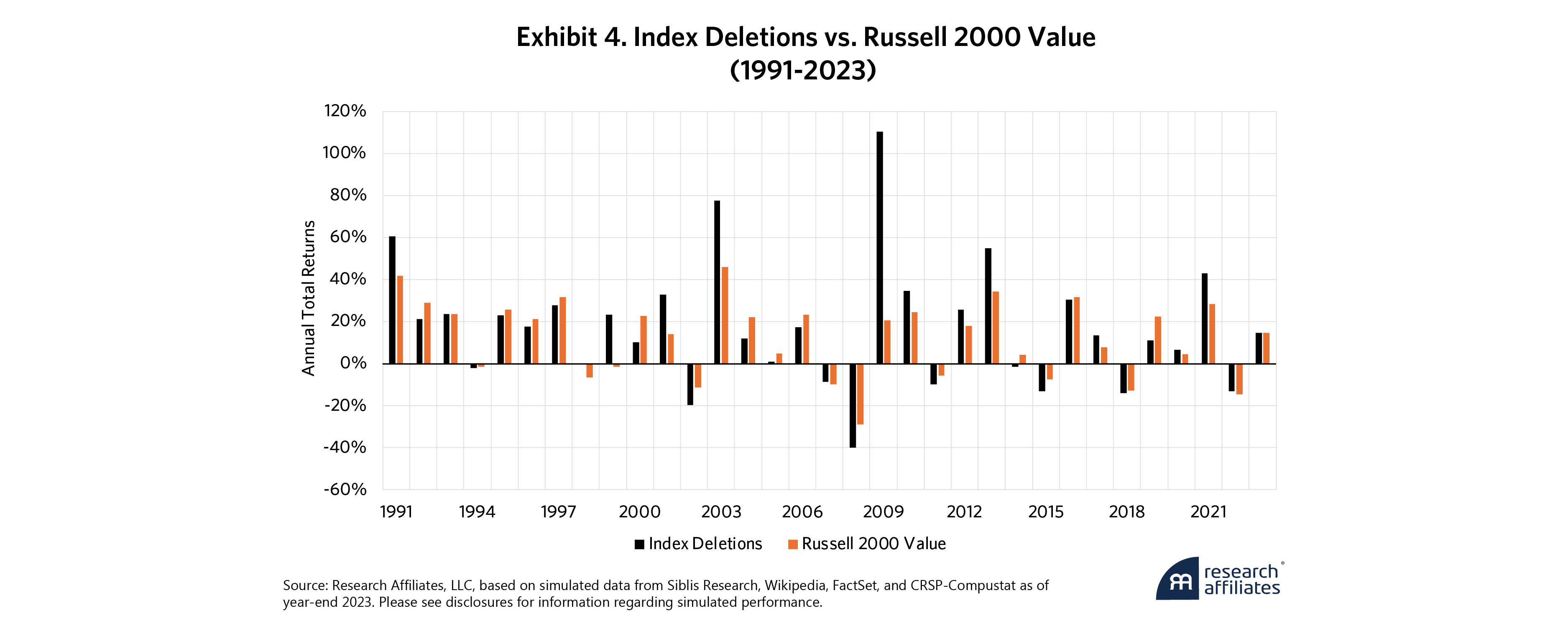

”Historically, deletions have beaten the Russell 2000 Value Index in impressive fashion. Exhibit 4 shows that when deletions outpace the Russell 2000 Value, they win by more than 18%, on average. In its best year, 2009, the deletions portfolio exceeded its benchmark by 90%, and in seven additional years, deletions outperformed the Russell 2000 Value by more than 10%. When deletions underperform, they lag by 5.3% on average, with a shortfall of over 10% only twice. Deletions may well add abnormal upside to a portfolio when the current growth-dominated bubble (and, yes, it is a bubble) starts to deflate.

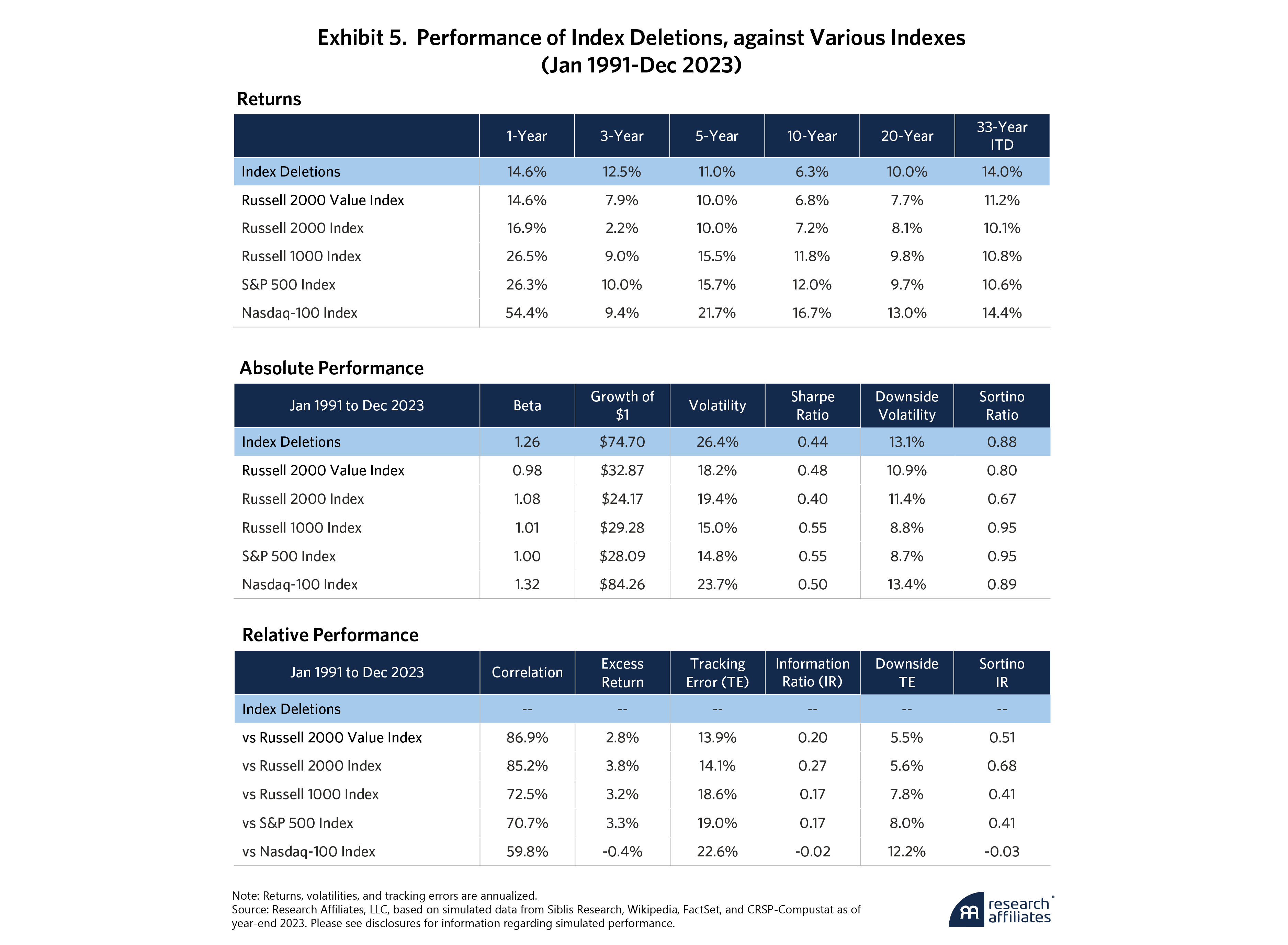

Exhibit 5 shows how well the deletions strategy holds up against various alternative indexes. To be sure, as of year-end 2023, it lagged the S&P 500 and Russell 1000, but it matched the Russell 2000 Value, with which it had the highest correlation and the lowest tracking error. The value-added, 14% per annum, is nearly as high as the rather large 19% tracking error to the S&P 500. But again, the deletions strategy has a penchant for extreme upside returns, so the total tracking can be misleading. By excluding the upside volatility and instead focusing on the downside tracking error, the portfolio delivers a much more palatable 8.0% tracking error to the S&P 500.

We carried out robustness checks to see whether our results were unique to published indexes like the S&P 500 and Russell 1000. We created hypothetical indexes of the 500 and 1,000 largest market-cap stocks to approximate the decisions of the S&P Index Committee and FTSE-Russell, respectively.9 We call these “True Cap” indexes because the decision process is utterly trivial, with no subjectivity whatsoever.

Do dumped True Cap stocks also win in the years following their deletion? The results are surprisingly similar. In other words, this work is not in any way a criticism of the decisions that the major index providers are making. Quite the contrary. The alpha stems from the market inefficiencies created by the process of adding stocks that have recently soared onto the top 500 or top 1,000 list and deleting those that have tumbled off the list. There is no need to use the actual S&P, Russell, or Nasdaq indexes. A roster of “deletions” from any cap-selected and cap-weighted index will do!

Closing Observations

Of course, searching through data for relationships and fitting our preferred narrative to those data is not scientific method, it is backtesting. Even if the results are not data-mined, our inquiries thus far suffer from that flaw. To our knowledge, no one has managed a deletions strategy over the last 30 years. Too many in our industry use backtests to improve backtest results. That is an excellent way to develop a great backtest and a terrible way to win in the future. Scientific method requires we use data to test a prior hypothesis, not to refine the model.

Index producers aren’t especially subtle in their addition and deletion decisions. They inevitably add popular and expensive stocks and dump cheap and unloved ones. This simple truth provided much of the motivation for our launch of the RAFI concept, which selects and weights index stocks by the fundamental size, the macroeconomic footprint, of the underlying business. That the data demonstrates deletions historically outperform additions in the years after index reconstitution is no surprise to us.

Deletions historically outperform the market for at least five years post-breakup. Their annual outperformance is remarkably persistent and statistically significant, averaging over 5% per annum, compounded over the first five years.

”The deletions strategy is a wonderful Occam’s razor to help identify the most depressed and unloved stocks. These may enjoy abnormally powerful performance rebounds, especially since the deletion process will only depress them more.

Such intriguing results have inspired us to take these investigations further and test these hypotheses in the real world. Today’s launch of the Research Affiliates Deletions Index (NIXT) is the first step in that direction. The NIXT index buys deletions from top 500 and top 1,000 market-cap weighted indexes, holds them for five years, and rebalances them annually to equal weight. This empirically has substantial overlap with the Russell 1000 and S&P 500 deletions and with very similar results. For the past 30 years, stocks have rebounded well after being dumped by an index. We’re looking forward to seeing if they maintain that resilience in the decades ahead.

Appendix 1. Separate Results for S&P 500, Russell 1000, and Nasdaq-100 Deletions

Appendix 2. Selecting the “Correct” Benchmark and Factor Attribution

End Notes

1. Arnott, Rob, Vitali Kalesnik, and Lillian Wu. “Buy High and Sell Low with Index Funds!” June 2018. Research Affiliates; Arnott, Rob, et al. “Reimagining Index Funds.” 2023. Journal of Investment Management; Arnott, Rob, et al. “Earning Alpha by Avoiding the Index Rebalancing Crowd.” 2023. Financial Analysts Journal.

2. See Arnott, Rob, and Engin Kose. “Can Momentum Investing Be Saved?” October 2017. Research Affiliates.

3. Chinco, Alex, and Marco Sammon. “The Passive-Ownership Share Is Double What You Think It Is.” July 2024. Journal of Financial Economics.

4. Separate results for the S&P 500, Russell 1000, and Nasdaq 100 deletions are presented in the appendix. For simplicity, we start the clock at the end of the deletion month. Russell deletions underperform by more than S&P 500 deletions during their deletion year, with the deletions more than halving relative to the Russell 1000.

5. Arnott, Rob, et al. “Earning Alpha by Avoiding the Index Rebalancing Crowd.” 2023. Financial Analysts Journal.

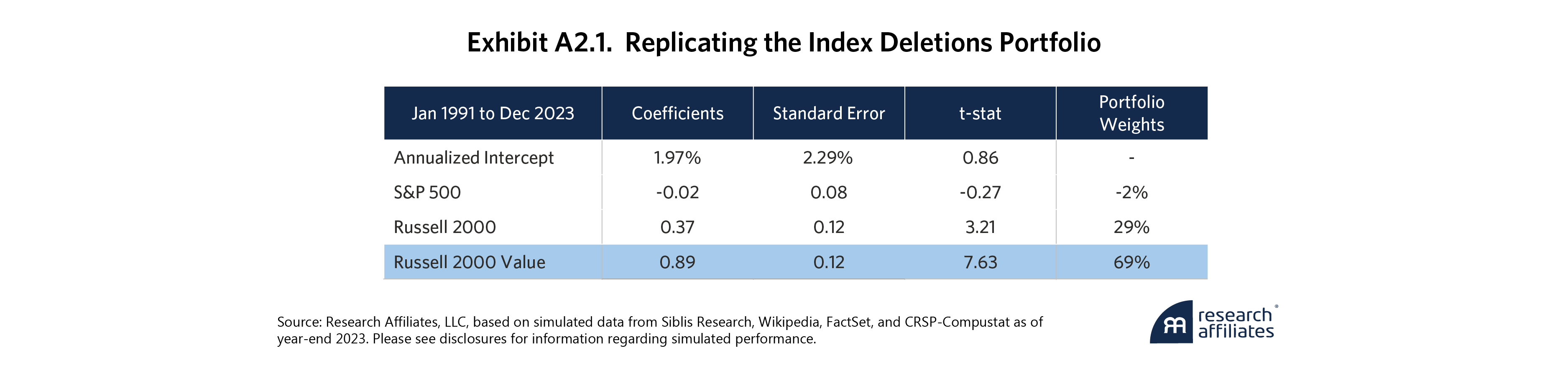

6. Regression analysis indicates this is the “correct” benchmark. Per Table A2.1, when we regress this deletions portfolio against the S&P 500, Russell 2000, and Russell 2000 Value, the majority weight (nearly 70%) is on the Russell 2000 Value. Nasdaq 100 deletions are a bit different. Since they are usually no longer S&P 500 members by the time they are dumped from the Nasdaq100, they are mid-cap value stocks. The Russell 2000 Value is still the better fit, however, because top 500 stocks dominate the Russell 1000 Value.

7. Hendrix, Kaitlin, Jerry Liu, and Trey Roberts. “Measuring the Cost of Index Reconstitution: A 10-Year Perspective.” 2024. Dimensional Fund Advisors

8. van der Beck, Philippe, Jean-Philippe Bouchaud, and Dario Villamaina. “Ponzi Funds.” 2024. S&P Global Market Intelligence via SSRN.

9. We also added 10% banding, so that we won’t introduce undue turnover. So stocks aren’t added until they are in the top 450 or 900, and deletions typically have to fall to rank 550 or 1100. The result closely resembles the S&P 500 and the Russell 1000 without intruding on their IP. Unsurprisingly, there is substantial overlap with S&P and Russell deletions.

Disclosures

The material contained in this document is for informational purposes only. This material is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument, nor is it advice or a recommendation to enter into any transaction.

Certain performance information presented represents simulated performance or performance based on combined simulated index data (pre-index launch) and live index data (post-index launch). Indexes are unmanaged and cannot be invested in directly. Past simulated performance is no guarantee of future performance and does not represent actual performance of an investment product based on an index. No allowance has been made for trading costs, management fees, or other costs associated with asset management, as the information provided relates only to the index itself. Actual investment results will differ. The simulated data may have under- or over-compensated for the impact, if any, of certain market factors. Simulated returns may not reflect the impact that material economic and market factors might have had on the advisor's decision making if the advisor were actually managing clients' money. Simulated data is subject to the fact that it is designed with the benefit of hindsight. Simulated returns carry the risk that actual performance is not as depicted due to inaccurate predictive modeling. Simulated returns cannot predict how an investment strategy will perform in the future. Simulated returns should not be considered indicative of the skill of the advisor. Investors may experience loss of all or some of their investment.

© 2024 Research Affiliates, LLC. All rights reserved. Duplication or dissemination prohibited without prior written permission.