Commonly Used Definitions

What is “fundamental weighting”

Fundamental weighting, also referred to as RAFI™ weighting, selects and weights securities based on fundamental measures of a company's size rather than based on market capitalization. The goal is to sever the link between price and weight in the index construction process and rebalance back to this non-price-weighted measure that is still representative of company size. The premise of the Fundamental Index™ methodology is that markets are not efficient and mean revert over time. This approach to index construction essentially creates a disciplined buy-low, sell-high investment strategy that active managers have been using for decades, but does so in a transparent, rules-based, high-capacity and high-liquidity, low-turnover and low-cost index construct. The methodology was originally presented in the article "Fundamental Indexation" by Arnott, Hsu, and Moore (2005) and showed excess annual returns of 2% over market-capitalization-weighted indices.

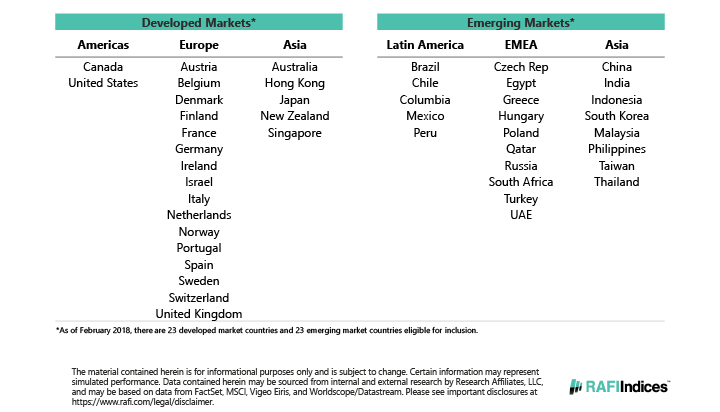

What countries are included in each region as defined by Research Affiliates?

The following countries are eligible for inclusion:

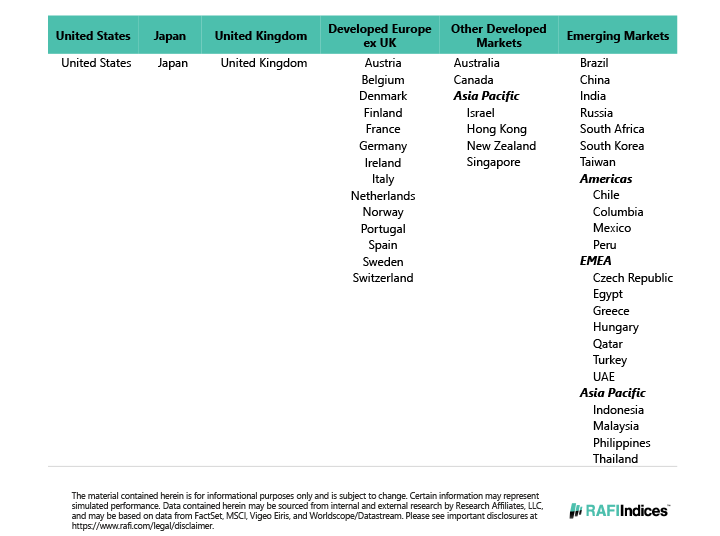

The country groups used for ranking securities are shown in the table below:

How are countries assigned for each company:

The starting rules for country assignment are based on country of primary listing, domicile, and incorporation.

| IF | Primary listing = Country of domicile = Country where incorporated | |

| THEN | Company is assigned to country of primary listing | |

| IF | Primary listing = Country of domicile ≠ Country where incorporated | |

| THEN | Company is assigned to country of primary listing and domicile | |

| IF | Primary listing ≠ Country of domicile = Country where incorporated | |

| THEN | Company is assigned to Country of Domicile and Incorporation | |

| IF | Primary domicile ≠ Country of domicile ≠ Country where incorporated | |

| THEN | Country assignment is based on other factors such as management location, domicile of parent company, etc. |

What is quarterly staggered rebalancing?

Through quarterly staggered rebalancing, the model portfolio is split into four equal tranches (A, B, C, and D). Each tranche consists of an identical portfolio. At the first rebalance (which occurs in March), each tranche is equally weighted. Each tranche is a full-fledged model portfolio and is rebalanced on a year to target weights determined for that quarter.

For example, for the RAFI Fundamental US portfolio, in the initial launch the four tranches (A, B, C, and D tranches) are identical portfolios. The headline portfolio will consist of 25% of each of the four tranches and, as such, the headline portfolio is the same as the underlying tranches in the initial launch. At the first quarter rebalance, tranche A is replaced, but tranches B, C, and D are not rebalanced and are drifted until the next rebalance. The headline portfolio will change reflecting the update to the rebalanced tranche A. Then, at the next quarter rebalance, tranche B is replaced and the other three tranches are not and are drifted until the next rebalance.

What does “contrarian rebalancing” mean?

Traditional market-capitalization-weighted indices systematically overweight overvalued securities and underweight undervalued securities. The reason for this is that as the price of a security becomes more expensive, it assumes a larger portion of the overall index weight. In other words, market-cap-weighted indices buy high and sell low. Alternatively, the use of fundamental weighting results in a disciplined buy-low, sell-high investment strategy, or contrarian rebalancing.